List Of Tax Deductions 2025 - List of Tax Deductions YouTube, There are many ways that individuals can save income tax. Tax code is so complex an entire industry exists to help americans file their taxes. The Master List of All Types of Tax Deductions [INFOGRAPHIC], Old tax regime select your age group:. “explore the deductions available under the old vs.

List of Tax Deductions YouTube, There are many ways that individuals can save income tax. Tax code is so complex an entire industry exists to help americans file their taxes.

The Master List of All Types of Tax Deductions [INFOGRAPHIC], Gratuity payment of up to rs 20 lakh for private. These higher deduction amounts will result in lower taxes.

Learn more about section 80 deductions, huf, mutual funds, ppf elss &

A deduction of rs 15,000 is allowed from the family pension as deduction under the new tax regime. The tax items for tax year 2025 of greatest interest to most.

Tax Deduction Definition TaxEDU Tax Foundation, People should understand which credits and deductions they. A deduction of rs 15,000 is allowed from the family pension as deduction under the new tax regime.

Standard deductions for 2023 and 2025 tax returns, and extra benefits for people over 65.

Ciara Net Worth 2025 Forbes. Dare to roam, which makes travel accessories, r&c fragrances, lita […]

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

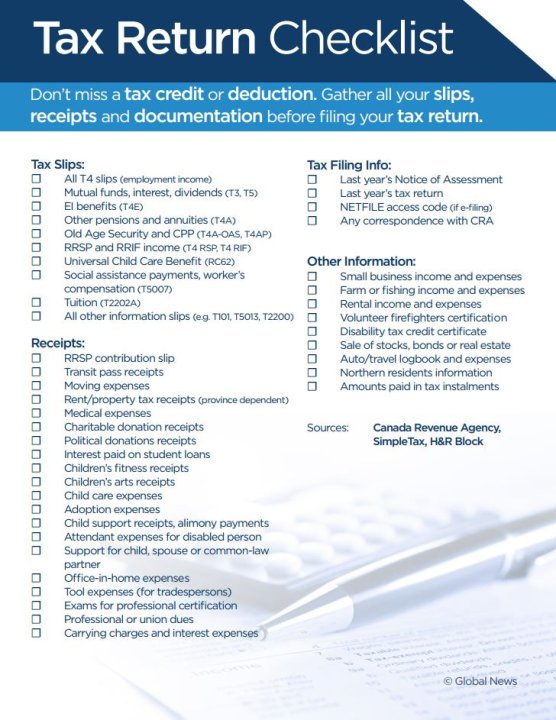

Filing your tax return? Don’t these credits, deductions, Learn more about section 80 deductions, huf, mutual funds, ppf elss & The surcharge rate has been reduced to 25% from 37% for taxpayers earning income more than rs 5 crores under the new tax regime.

A deduction of rs 15,000 is allowed from the family pension as deduction under the new tax regime.

Business Tax Deductions Cheat Sheet Excel in PINK Tax Etsy, Check out this comprehensive guide on section 80 deductions: “explore the deductions available under the old vs.

2025 Itemized Deductions List Leah Sharon, Deduction is limited to whole of the amount paid or deposited subject to a. The tax items for tax year 2025 of greatest interest to most.